Drive brand growth by getting pricing right

Pricing, one of the 4 (or 7) Ps of marketing, is one of the easiest levers for a brand marketer to change but at the same time is arguably the most important aspect of marketing to get right. Price discussions have become even more important and more frequent in the last few years with the increased cost of living both in NZ and around the world.

Now, more than ever, it is critical to understand the pricing dynamics in your market – both within your own brand portfolio and that of your competitors – to ensure the price of your products are optimised. You could be leaving money on the table if your pricing strategy isn’t right!

We have seen examples from pricing studies in New Zealand over the last couple of years of brands that aren’t charging the right price for their products across different markets. If you have less than optimal prices, you could:

- Be charging too much for your product or service, in which case a price reduction would result in higher market share and/or profits. Alternatively, if you think the higher price is right, you may need to revisit your brand’s meaningful difference, with the current brand predisposition only weakly supporting the higher price.

- Not be charging enough for your product or service, whereby a price increase would result in minimal loss of market share but a significant increase in value and/or profitability.

Predispose more people to pay the right price

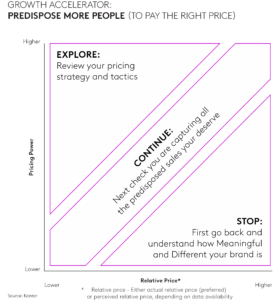

One of the “Growth Accelerators” from Kantar’s Blueprint for Brand Growth (Predispose more people to pay the right price) highlights this. On the chart below, brands below the diagonal line have prices that exceed current pricing perceptions for the brand and may either need to reduce their prices or revisit their Meaningful Difference to be able to sustain the current price. Brands above the diagonal line however have lower pricing than people expect and may be able to charge more for their products or services without adversely affecting market share.

Following a similar theme, we have seen examples of product portfolios that have the same price for multiple brands of a certain size. This could potentially benefit from a different pricing strategy of independent pricing for the different brands. Because all brands have different levels of price sensitivity, it may make more business sense to price the more price sensitive brands lower and the less price sensitive brands higher, as they are able to withstand a rise in price without sacrificing significant share.

How promotions can impact consumer purchasing behaviour

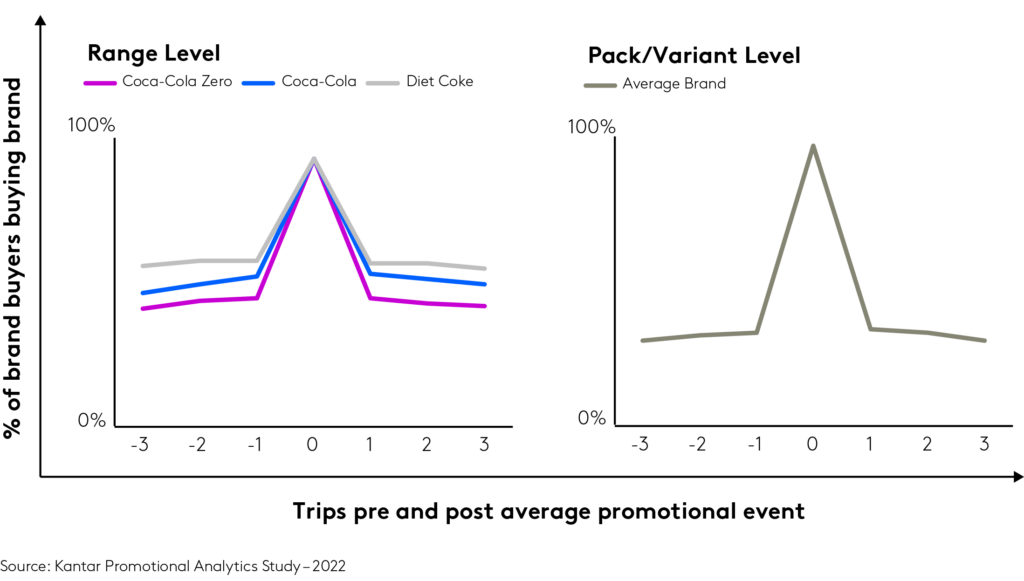

Finally, some thought on promotional pricing. New Zealand is a nation of people who love a discount, and our supermarket chains have regular promotions or discounts on many of our most commonly purchased items. Work done overseas in the sparkling soft drink category shows how promotions impact consumer purchasing behaviour, with some incremental category and brand growth but a significant amount of lost value through purchases made by people who would have bought anyway.

Short-term volume lifts as a result of promotions are obvious in sales data for the relevant brand, but in expendable categories such as soft drinks, they rarely last longer than the week the product is on promotion.

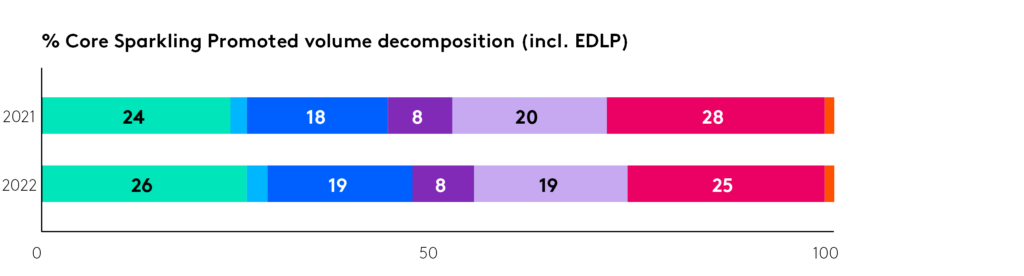

But not all sales lifts are as beneficial to the brand or portfolio as others. The chart below shows some results from the sparkling soft drinks category based on promotional activity during a 2-year period from 2021-2022. Roughly a quarter of the promotional volume is “category expansion”, either bringing in more volume from people who already buy the product or bringing in a small amount of volume from shoppers who don’t typically buy in the category at all.

Just over a quarter of the volume is either “stolen” from competitor brands, perhaps the ideal scenario for the manufacturer, or “cannibalised” from other brands within the promoted manufacturer’s portfolio.

However, a large proportion of the products bought on promotion are either “subsidised”, from people who would have bought the product anyway so we are effectively subsidising their purchase; or “displaced”, where people would have bought the product at a later date but have brought the purchase forward due to the promotional price. This 40%+ volume is giving money away.

In summary, pricing is a key marketing lever for brand managers but knowing the relative price sensitivity of your brand and other brands in the category can greatly improve your chances of getting your pricing strategy right and driving brand growth. And although promotions can bring in significant sales increases, they need to be carefully managed by brands as they could be either subsidising consumers who would have bought anyway or cannibalising from your own wider portfolio of brands.

If you’d like to hear more or learn how we can help with your pricing strategy, please get in touch.

Duncan Smith

Analytics Director

[email protected]